Auto insurance costs too much! Learn why here READ MORE

Home

Trouble in Toyland

FCAN releases the 37th annual

Trouble In Toyland report on dangerous toys.

US Representative Kathy Castor announces the release of FCAN's 2022 Trouble in Toyland report at St. Joseph's Children's Hospital

DANGEROUS TOYS | Rep. Kathy Castor is talking about the annual Trouble in Toyland report, aimed at protecting children from dangerous toys. Story >> http://bit.ly/2Dpn2dC

Posted by ABC Action News - WFTS - Tampa Bay on Wednesday, November 27, 2019

New Blog Post

FCAN and Americans for Financial Reform on WSLR-FM

Americans for Financial Reform (AFR) Consumer and Payday Campaigns Manager Candace Archer Ph.D. and Bill Newton, FCAN Deputy Director appear on WLSR's Peace and Justice Report with Tom Walker to discuss predatory lending, the CFPB, and consumer financial reform.

******************************************************************************

Time to Reign In Florida Predatory Lenders

High-Cost Predatory Rent-a-Bank Schemes in Florida

<

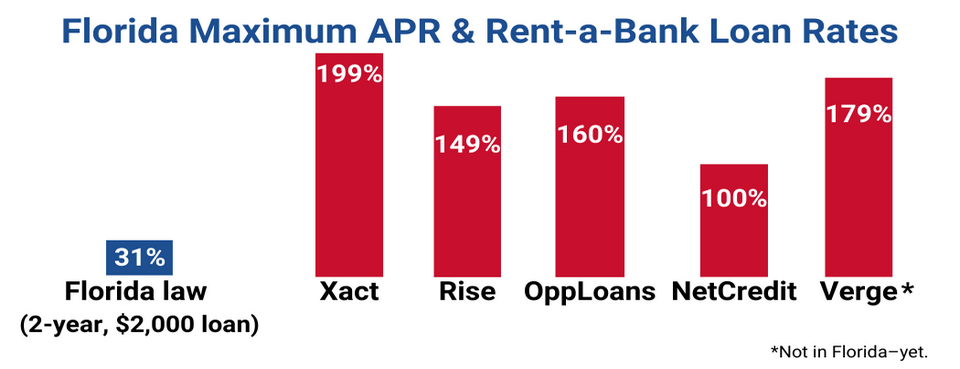

Florida law limits interest rates to protect its residents from predatory lending.

But high-cost online lenders are evading Florida law by laundering their loans

through rogue, out-of-state banks, which are not subject to state rate caps. In a “rent-abank” scheme, a loan program is designed and run by a nonbank lender that charges and

collects interest and makes the bulk of the profits. But a bank’s name is on the paperwork,

and the lender claims it is a “bank loan” exempt from state law. Predatory rent-a-bank

lending hurts consumers, disabled veterans, and small business owners who can lose their homes to 121%

APR loans.

These installment lenders are now using rent-a-bank schemes to evade Florida law1:

- EasyPay offers high-cost credit through businesses across the country that sell auto

repairs, furniture, home appliances, pets, wheels, and tires, among other items. EasyPay’s website

does not disclose its rates, but examples from consumers in some states include $1,500 loans

at 189% APR, funneled through Transportation Alliance Bank, Inc. dba TAB Bank (Utah). - Elevate’s Rise uses FinWise Bank or CC Bank, both of Utah, to make $500 to $5,000 loans with

APRs of 99% to 149%. - Enova, which operates the CashNetUSA payday loan stores, uses NetCredit to make installment loans of

$1,000 to $10,000 with APRs up to 100% through Republic Bank & Trust of Kentucky. - OppLoans (aka OppFi) makes $400 to $4,000 loans at 160% APR through FinWise Bank, First Electronic

Bank of Utah, or CC Bank. - Axcess Financial, which operates the Check 'n Go and Allied Cash Advance payday loan stores, uses CC

Bank to offer Xact installment loans of $1,000 to $5,000 at 145% APR to 225% APR. - Florida small businesses, including a realty company and a general contractor, have also been subject to

73% to 100% APR rent-a-bank loans by World Business Lenders. Borrowers had no contact with the bank

and WBL in some cases signed the bank’s name using a power of attorney.

1. Source: National Consumer Law Center https://www.nclc.org/issues/high-cost-small-loans/rent-a-bank-loan-watch-list.html

The legality of rent-a-bank schemes is questionable. But in 2020, the Office of the Comptroller of the Currency approved a “fake lender” rule that prevents courts from following the money to prevent usury law evasions. A second set of OCC and FDIC rules preempting state rate caps on assigned loans also help protect high-cost loans laundered through banks. Both rules have been challenged.

To preserve Florida’s authority to stop predatory lending, we must:

- Overturn recent FDIC and OCC rules that protect “rent-a-bank” schemes.

- Stop banks from helping high-cost nonbank lenders evade state law.

- Enact a national 36% interest rate cap covering all lenders, including banks, and allow states to set

lower limits.

*********************************************************************************

Fight for Lower Auto Insurance Rates: Florida 3rd highest in the nation!

The Florida Legislature just passed an innovative auto insurance law that removes PIP Personal Injury Protection. It is replaced with mandatory Bodily Injury Coverage at $25,000 for the driver, and $50,000 per accident.  Unfortunately, Gov. DeSantis vetoed the bill, meaning your auto insurance will stay exactly the same at least until next year.

If signed, the bill would mean better insurance with a higher benefit for consumers. But some consumers, mainly those who now chose the low $10,000 coverage, would pay more. The average savings should be about 35% or $350 per year.

Sign SB 54 to Repeal PIP and lower auto insurance rates by $350 per year!

Sign SB 54 to Repeal PIP and lower auto insurance rates by $350 per year!Reduce Fraud

Florida is a hotbed for fraud, but eliminating PIP will reduce fraud. Tougher law enforcement and resources for investigations are still needed.

Gov. Ron DeSantis vetoed Senate Bill 54, the repeal of PIP and replacement with mandatory BI. Studies show drivers will save about 35% or $350 per year if Gov. DeSantis had signed the bill.

Excerpt from today's FCAN Press Release:

FCAN Executive Director Susan McGrath stated, "PIP Repeal/Mandatory BI with $25/$50k mandatory Bodily Injury liability coverage is in the best interest of most consumers. It should lower rates for many consumers and provide better coverage. According to McGrath, "There is an option in the bill that allows drivers to still choose PIP-like Medical Payments coverage, but many drivers, especially seniors with Medicare, may choose to avoid that coverage because their health insurance or Medicare already covers them. FCAN also thinks the new law will reduce Florida's uninsured drivers and the fraud associated with PIP."

An analysis by the Florida Office of Insurance Regulation in 2016 found that repealing PIP and replacing with BI at $25/$50 would result in an average 9.6% savings for most Floridians. A new 2021 study says savings would average $350 per driver annually or 18%. However, some Floridians who now carry only the minimum $10,000 coverage or have no insurance, would see higher rates, but they would benefit from more coverage.

*******************************************************

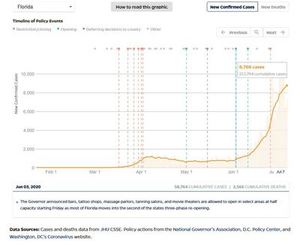

FCAN COVIDLiability Immunity Project

The Florida House of Representatives is considering HB 7, a bill that would exempt many businesses from lawsuits when they may be responsible for exposing staff, customers, or the public to the virus through carelessness or negligence. Read more here.

Protect Public Health NOT Superspreaders!

Oppose Senate Bill 72 and House Bill 7

Read FCAN Statements on these bills

FCAN COVID-19 Emergency Response

The COVID-19 pandemic poses an unprecedented challenge for our country, threatening our health, wellbeing, and democracy. Now more than ever, we need to work together to ensure that our government has a coordinated, strategic response to safeguard the public’s health, protect consumers from emerging dangers and ensure people can still participate fully in our democracy.

Too Dangerous to Open Florida?

Open Safe FL.pdf Open Safe Release.docx

NEW OpenSafe FL Facts.pdf NEW 7.9.20 Open Safe Week 2 release.docx,

From Johns Hopkins University of Medicine From Johns Hopkins University of MedicineJuly 08, 2020 |

FCAN and national partners have assembled a COVID-19 response team of policy experts, advocates, organizers, and researchers. If we all pull together, we can find concrete ways to protect public health, consumers, and our democracy. Click here for more information: |

More Testing Needed - Protect Healthcare Workers - Consumer Tips for Coping - Prevent Price Gouging - Safely Reopen - Release Ventilator Repair Information - Protect Consumer Credit - Stop Bad Bailouts - 25 Things to do at Home - Much more

FCAN's Comprehensive Response to the Florida Covid-19 Surge

_________________________________________________________________________

Hurricane Season is Here! FCAN Helps you get ready

FCAN 2020 Hurricane Media Guide -- resources, data, more from FCAN and the Public Interest Network

Strengthen Our Homes -- FCAN oped on the need for stronger building codes

Hurricane Resilience -- How Can Communities Become Resilient?

Consumer updates:

Unsafe Used Cars (docx file)

FCAN Payday lending press release (pdf) Feb 2, 2019